|  |

|

A short History of Bronte |

The cards, the places, the memory ... |  |  |

| You are in: Home–› History–› The Mutual Bank

|

Bronte's History The Mutual Agrarian Bank Founded in 1912 for ninety years he supported the Bronte's economy  During the first years of ‘900 the precarious economic situation, the lack of capital sums available at a reasonable cost, the poverty and the miserable condition of the peasants of Bronte made it necessary to create small cooperative credit institutes, founded by local priests to sustain the needy agricultural classes. During the first years of ‘900 the precarious economic situation, the lack of capital sums available at a reasonable cost, the poverty and the miserable condition of the peasants of Bronte made it necessary to create small cooperative credit institutes, founded by local priests to sustain the needy agricultural classes.

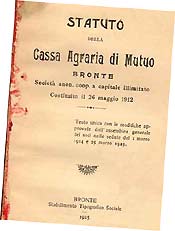

Their purpose, besides the economic, civic and religious advantages for the partners, was to offer, together with the money lending, some help to the needy. The first institute, founded in 1903, was The Mutual Agricultural Bank Nicola Spedalieri; with only three members (Nunzio Salanitri, Antonino Biuso and Zerbo Salvatore). The purpose of the company was the social and economic improvement of its users and, depending on availability, without any gain or speculation in mind, helping the poorest in the town by lending some money when necessary ...” It was active for nearly 40 years: In 1909 the members, small property owners, farmers, tenant farmers and laborers were 202. Between its presidents there is also father Giuseppe Salanitri, founder of the Piccolo Seminary. After the second world war was put into liquidation and wound up. Subsequently, in 1907, Carmelo Schilirò of Carmelo, Schilirò Carmelo of Mario, Antonino Alessandro, Pasquale Longhitano e Portaro Giuseppe founded The Agricultural Loans and Deposits Bank: it provided also loans in kind and had the same attributes of the original agricultural bank, (in addition it had a religious improvement and many more requirements for admission as a member: could be admitted only people “who had professional abilities and catholic religion,..”). Witness of the constitutive act were the priests Mariano Rossi and Domenico Cariola. To save the needy from the usurer’s claws, in 1910 Francesco Cimbali founds The Enrico Cimbali Deposits and Loans Popular Bank of which was also, for many years, President. Gave to it the name of his brother Enrico, great jurist who had died very young in 1887. The head office of the bank was located in Ospedale Vecchio street and one of its president was the priest Domenico Cariola who had been one of the founders of the Mutual Agricultural Bank but, since then, had come in disagreement with the top management of the Bank. In a country town of only 20 thousand inhabitants, the majority of which were laborers, poor peasants “without a handkerchief of land” and small artisans, was taking place a frenetic proliferation of credit initiatives with welfare purposes and charity work to help the poor people. The "Cassa Agraria di Mutuo" (Mutual Agricultural Bank) was founded five years later, the 26 May 1912, “reigning Vittorio Emanuele Third for grace of God and by the will of the nation King of Italy”, in substitution of The Agricultural Deposits and loans Bank. The gentlemen who wanted it were: “Ignazio Calì, Sanfilippo Vincenzo, Portaro Giuseppe, Schilirò Vincenzo, Cariola Domenico, Sanfilippo Francesco and Sofia Salvatore, all of them property owners, born and resident in Bronte”. They set up a Cooperative Anonymous Company with unlimited capital called «Mutual Agricultural Bank» whose purpose was "the moral and material improvement of its members and all workers in general, by lending to them the necessary funds, directing them to work cooperation and assuming for them, without risk, work, production or exchange enterprises”.

Can “belong” to the Company those who “accept the present Statute; are land owners, or farmers, tenant farmers or sharecroppers; domiciled or that keep frequent residence in Bronte, or that have in it business relationship”. With a successive amendment in 1927 among the requirements to be admitted as a member was added “to be obedient to the catholic religion and to all the national institutions”. To try to help the peasants and overcome the availability of capital at a reasonable cost, the Bank could also operate according to laws (23.1.1887 and 29.3.1906 ) for Agricultural Credit and: grant to its members and others, loans in kind or in money for one or more of the following reasons: "a) for harvesting, b) for cultivation, c) for the seeds, d) for fertilizers, e) for anti-cryptogamic chemicals and insecticides , f) to provide the country estates of stock alive or dead, of agricultural tools and machinery, g) and for any other reason specified in the article 20 of the 29 March 1906 law”. | More than a third of the profit was to be spent in charity work; in the article 60 of the Statute was in fact stated that ”the net profit of the Bank, at the end of each social year, would be allocated as follows: 30% to the reserve fund, 35% to the members as dividend in proportion to the invested shares. 35% would be allocated by the management to charity work and publicity in accordance to the spirit of the institution". For some decades the charity work and the publicity were concrete and tangible. The construction and the opening of the Bronte’s Hospital, devised by another priest, Giuseppe Prestianni (1849-1924), rector of the Real Capizzi College from 1892 to 1924, were also made possible by the generous contributions of the Agrarian Bank that for some years assigned large sums for the completion of the central building (balances 1921, 1922 and 1923 for a total of 28.000 lire). Again in 1925 the Charity Congregation that was managing the Hospital had a debt of 19.010,70 lire that was extinguished "with an offer given by The Agrarian Mutual Bank on the balance of 1924 (for 17.000 lire) and additional generous donations by other institutions and benefactors". The first financial year of the Agrarian Bank (1913) was showing a social capital of 14.862,89 lire a fund-raising of 232.623,70 lire and a net profit of 1.399,68 lire ( 366,74 of which were allocated to charity). In 1925 the Bank was still managed by two priests: Benerdetto Ciraldo, president and Antonino Zingale, deputy president; at closing balance had 62 share holders, with a social capital of 227. 566,70 lire, deposits amounting to 5.031.390,85 lire, a profit of 70.578,68 ( of which 17.177,54 were put aside for charitable work). |

|  | The head office of the Popular Bank of Bronte in a photo of 1974 and in a china by Mario Schilirò. |  |

| The original denomination of «Cassa Agraria di Mutuo», (Mutual Agrarian Bank) established by the social statute of 1912, was changed to «Cassa di Mutuo» (Mutual Bank) in 1933; afterwards the 31st of March 1940 the name changed again in «Banca di Mutuo». The fund that the management could allocate to charity and publicity was reduced from 35% to 15% of the net profit. The precarious economic conditions of Bronte populations were radically changed and the ancient Mutual Agrarian Bank was gradually loosing the original social purposes of moral improvement, and help to the needy to become an actual business company. The 30th of July 1950, to conform to the new rules of law, the company was changed into a cooperative company property limited, the nominal value of the shares was increased from 30 to 500 lire and the name modified again in «Banca Mutua Popolare di Bronte». It was also fixed to 99 years the duration of the company from 26th of May 1912 to 25th of May 2011. Managed always with caution and inspired to healthy principles, the ancient Agrarian Bank became in a short while a powerful factor of social-economic growth for the small town at the feet of Etna. “In the spirit of cooperation” performed its credit activity oriented to welfare, always “seriously and honestly” and always ready to “favor, whenever possible, the needs of all economic operators, applying rates inferior to what was commonly charged by other credit institutes”. Could be said that in favor of Bronte and of its poor local economy has realized for nearly a century what the Real Capizzi College did in the cultural and educational fields. During nearly a century of activity was guided by father Benedetto Ciraldo, Luigi Margaglio, Nunzio De Luca, Vincenzo Calì (to him and to Gino Isola, director for nearly twenty years, was due the exceptional success reached by the institute during the last years), by Nunzio Meli (from 1977 to 1996, who was also among the lord majors of Bronte) and at present by the lawyer Pietro De Luca. In the relation to the balance of 1974, the assessor Vincenzo Cali’ (deputy president of the Bank since 1947 and president from 1962 to October 1977), stated with regret the “extremely poor crop of almonds and oil, no increase in the cultivation of cereals and pulses, unprofitable meat prices”, but reported something positive about the newly established agricultural cooperative: the “Smeraldo” (Emerald, sustained by the bank ) “that appears to be reaching some good results in favor of the pistachio producers”. In 1977 the Bank, still with only one teller’s window in Bronte, assumed the management of the Council treasury “not only to enlarge its activities but also to demonstrate, in an actual way, its interest towards the collectivity.” In the same period the Bank, since 1912 operating only within Bronte’s territory, started a gradual expansion of its credit activity in nearby towns, opening affiliated branches in Maletto (1977), Maniace (1981), San Teodoro (1990), Catania (1990), Adrano, Giarre, Biancavilla. Remained yet a Bank “with a sense of proportion” always careful towards small local economies with which operated in perfect symbiosis. Administrated with a persistent auto-financing policy and great efficiency, its primary objective was not the profit only but rather the social improvement and the strengthening of agricultural, craftsmade and commercial activities of the areas in which it operates. In twenty years of activity (from 1962 to 1982) the Administrators brought the number of the members share holders from 94 to 321, the social patrimony from 67 millions lire to nearly 4 billions and the profit from 12 million and a half to one billion and 400 millions . The employees? Only 18, up to the end of 1983! In 1978 the extraordinary members assembly made new changes to the social Statute, increasing further the nominal value of the shares from 500 to 5000 lire. The 11th of September 1994 the social Statute was again adapted to the new law rules for credit and banking matters of 5th September 1993, n° 385. The trade name changed once again in «Banca Popolare di Bronte» - Soc. coop. a r.l. (Popular Bank of Bronte Pty. Ltd.). The life of the company extended to 25th of May 2050. But it was only a dream; few years after, in 1998, after nearly ninety years since its foundation, Bronte lost its well-deserving institution: after long negotiations, the Popular Bank of Bronte entered in fact in the credit group of the “Popular Bank of Lodi”. |

|  | Vincenzo Calì, from 1947 Vice President

and from 1962 at 1977 President of the Bank. |  | The knight Giuseppe Interdonato coverei the position of Bank Director until 19 59. Still at a young age was one of the promoters of the foundation of the «Cassa» (Bank) .During the war was also president of the Hospital Castiglione Prestianni and lord major of Bronte having been elected immediately after the war. |  | The knight Gino Isola, for over twenty years director of the Bank. |

|

| The 4th of October 1998 the members general assembly, called purposely to a meeting, changed the legal status of the Bank from a company Pty. Ltd. to a Joint-stock Company; was adopted a new statutory text in keeping with the indications of the purchasing Bank; the members accepted the public offer put by the Bank of Lodi and transferred to the same over the 51 % of the share capital, giving to the Lodi’ Bank the full control of the ancient “Mutual agrarian Bank”. The acquisition offer launched by the Bank of Lodi had, unfortunately, achieved a full and complete success! In 1998 the Bank had nine branches installed in the provinces of Catania and Messina with a total staff of only 61 dependents, property worth nearly 30 billions with a direct fund-raising of over 175 billions, a rich real-estate, counters always crowded and, above all, making profits (kept on producing profits since foundation; in the last balance, of 1997, the profit was over two and a half billions lire (nearly € 1.300.000). | The same year the Bank was awarded the Premio XXIV Casali for the economy as "irreplaceable point of reference for the Bronte economy". Certainly in the general credit landscape represented a small economic reality, it had been such for nearly a century for a precise choice by the various administrators, however it was a solid and healthy company, well established in its territory where didn’t fear competition because of affectionate and faithful customer relations. The last board of directors of local origin accepted in 1998 “with a clear satisfaction the positive result of the negotiations” which represented “a strategic choice highlighted on the future of the Bank”. The selling reason? The board of directors said: «The answer is simple: in a moment of total distress and of continuous social, juridical, economic, geographical and financial evolution (not to say revolution) one must be careful, must scan the horizon even for the small and most distant clouds, not to be caught unprepared by the smallest thunderstorm or the big storm. In other words, to say it with a rather abused slogan, “one must make the right choice at the right moment”. Only timeliness can allow us to be protagonists of our choices without being subjected later to accept them as external impositions; to propose, therefore, agreements without having to accept passively rules and conditions imposed by others».

«Now, in total serenity and conscience, the board of directors has perceived those clouds that we had mentioned before and that have invested many small, and some not so small, credit institutions; such clouds are still far enough from our horizon, our climate is certainly still mild and sunny; and, never the less, to speak explicitly, we can’t ignore the treats of the sudden change in the competitive environment of the Banks”. (…)

"The necessity to face up to greater competition, not only in Bank transactions, that already brings about a reduction of future profitability, together with the increasing cost of innovating processes and equipment necessary to generate new financial services, have convinced us that, among the possible solutions, the most reasonable was the search for alliances… |

|  | The President of the Bank, avv. Nunzio Meli, receives the Premium XXIV Casali - 1987 for the economy from the hands of the then Vice President of the Sicilian Region hon. Salvatore Leanza. |  |  The Head Office and the last logo of the Bank: it recalled the Bronte's economy based on agriculture and, above all on the Pistachio. The Head Office and the last logo of the Bank: it recalled the Bronte's economy based on agriculture and, above all on the Pistachio.

|

|

| The agreement, through organizational, commercial and professional strengthening, puts, therefore, as a primary objective, the creation of the bases from which to continue the development so far realized, consolidating further the positioning market of our institute.» Are transferred elsewhere the control and the decisional process of the Company, Bronte has been completely cut out, even the general management few years later (2001) has been transferred to Catania. The project of aggregation with its strong economic logic and the market requirements, uprooted the big tree planted in Bronte by father Ciraldo in 1912, cancelling an institution more social than economic, and all that had been achieved, throughout a century, with tenacity and intelligence. Bronte’s economy and the town itself lost one of its institution, one of the feathers in its cap, a point of strength that, for almost a century, had sustained the artisans, the farmers and the poor workers, all the modest economy of the territory, adopting and encouraging economic initiatives but also charitable and highly social ones ( see the remarkable contribute given for the Hospital construction in the years ’20 ). The glorious “Cassa Agraria di Mutuo” (Mutual agrarian Bank) nearly certainly shall not exist any longer within the 2002; During the year the Bank has lost all its real estate properties (ten buildings located in Bronte, Maletto, Adrano and Maniace) conferred to a company of the Lodi group: In April the same group leader Bank, trying to get total control, has launched a public offer of exchange for the acquisition of all the shares of the Popular Bank of Bronte of which already controls the 51,11 % of the capital.

|

|

|